Strong growth in SMSFs and the rapid development of technology make the sector an attractive opportunity for accountants wanting to grow their practice. However, these trends are also making it increasingly competitive and tech-dependent. Accountants who want to transform their SMSF business into a profit and growth centre need to get serious to succeed.

Accountants are looking for new ways to grow their business, with the ATO automating tax returns and low fee compliance work failing to pay the bills. The question they’re asking themselves today is what will they be doing in 5 years, where is their revenue stream going to come from?

SMSFs are a fantastic opportunity for accounting firms to leverage the skills and knowledge they already have in accounting and compliance to be able to provide a valued service to their clients and attract new business.

SMSFs are the largest and fastest growing sector of the super industry, with total assets up by 206 per cent to $621.7 billion in the past decade.*

Cloud-based administration software not only slashes admin time and workload but enables accountants to provide a level of service they wouldn’t have been able to just a few years ago

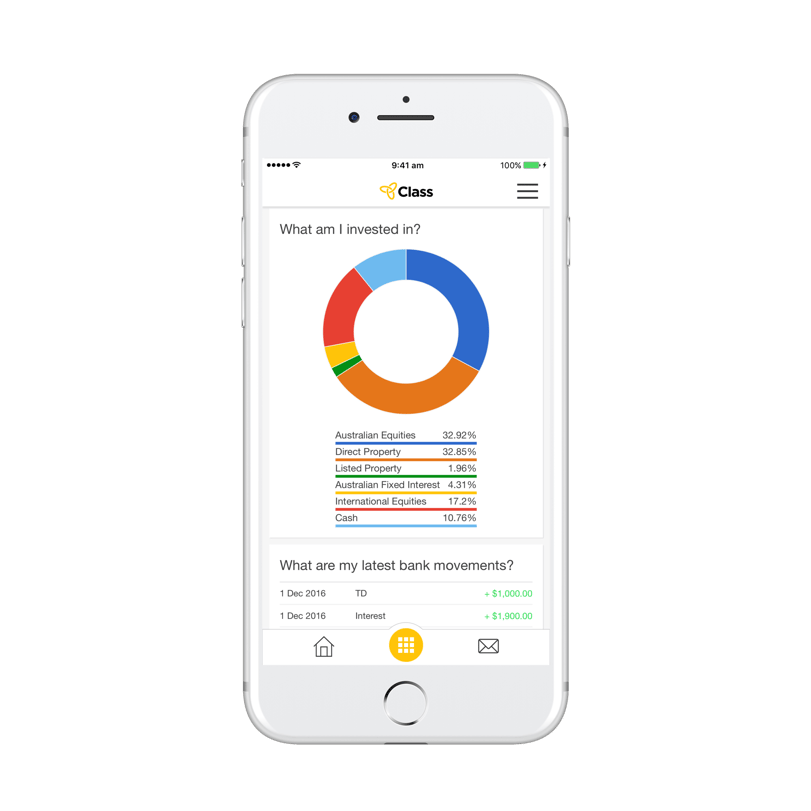

SMSF administration software is also advancing rapidly as developers exploit the advantages of cloud-based technologies. Cloud-based administration software not only slashes admin time and workload but also enables accountants to provide a level of service they wouldn’t have been able to just a few years ago, whether that’s providing clients an up to date view of their SMSF wealth on their smartphone, or sending electronic documents to finalise a tax return.

The cloud also makes administration more efficient by joining services together and enabling accountants, advisers and clients to share information. For example, automated data feeds from banks, brokers and wraps allow the software to automatically reconcile share trades and bank transactions, greatly improving productivity and profitability for your practice.

After their first year on Class, accountants have grown the number of portfolios they administer three times faster, on average, than the average industry growth rate.

However, technology does not remove the need for accountants – it removes the cost and inefficient manual processing but leaves the critical high-value decisions and strategy that only skilled accountants and advisers can provide, particularly in SMSFs. That’s why the sector is such a natural fit for the profession. Accountants are trusted, longstanding advisers to their clients and SMSFs are in need of good counsel more than ever amid the introduction of the biggest changes to super in more than a decade.

Technology will assist accountants to manage these changes, automate much of the manual work involved, while focusing on the value-adding role they do best.

And the benefits don’t stop with SMSFs. Clients who have investments in an SMSF also typically have investments outside super, such as a family trust or company, so SMSFs can also be a launch pad for a whole new area of business for accountants, as long as your cloud software provider handles wealth accounting of both super and non-super portfolios.

Many accounting firms have already launched themselves on this journey. The increasing sophistication of SMSF administration will make it harder for those accountants who are reticent to adopt new technology or for whom SMSFs are only a sideline. With the right technology, SMSFs can be the basis of a highly lucrative growth strategy for accountants, but the opportunity needs to be grabbed with both hands, and quickly.

To find out more about how technology can drive growth in your SMSF business and how Class can help, click here.

*APRA annual bulletin for the 12 months to June 30 2016

.png)

Grow your business. Request a personalised Demo.

We’re here to help. Why not request a demo, so you can see first-hand how intuitive our solutions are, and the dramatic productivity gains they can deliver?