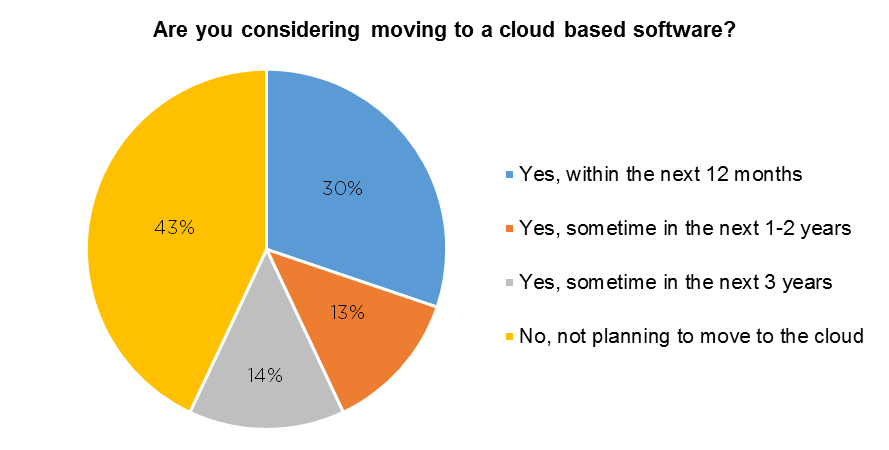

Almost a third of accountants and administrators are considering moving their portfolio administration to a cloud software solution within the next 12 months, to cut the time spent administering SMSFs and to boost their business growth.

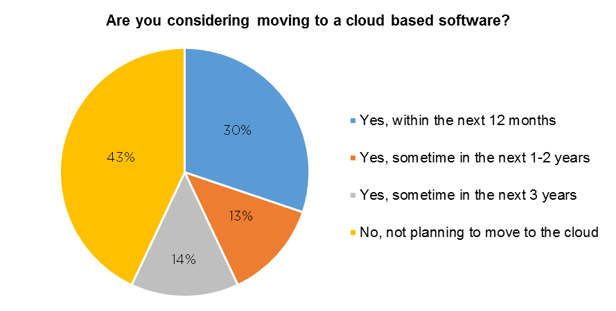

The Class Digital Trends Survey found 30% of respondents who were not using cloud software for portfolio administration said they were considering moving to the cloud within 12 months and 60% within the next three years. The most common reason cited was to reduce the time and cost spent administering SMSFs, although a substantial proportion, one quarter, said their primary reason for moving to the cloud was to achieve scalable growth in their SMSF business.

The survey was conducted to better understand the growing adoption of cloud-based SMSF and portfolio accounting software, as the drive for greater efficiency and the ramping up of regulatory and reporting obligations pressure accountants and administrators to abandon traditional administration methods.

The survey was conducted during the fourth quarter of 2016 by telephone and email.

Non-SMSF portfolios further behind in cloud adoption

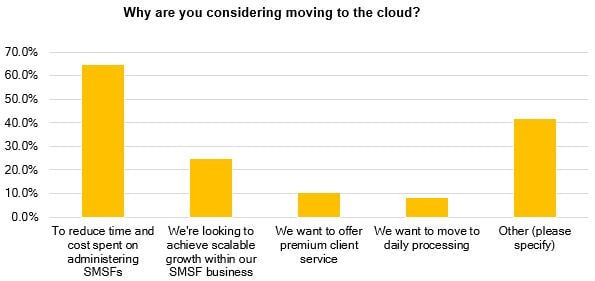

The survey also found that the administration of non-SMSF portfolios such as trusts and companies was still a heavily manual task for many accountants and well behind adoption of the cloud compared to SMSFs. While just 11% used manual methods like Excel to administer their clients’ SMSFs, a much larger 34% administered their non-SMSF portfolios manually.

The survey showed some administrators used generic accounting software packages to do some of the work in administering trusts and other non-SMSF structures, where assets are held beneficially. However, these aren’t designed to handle beneficiary accounting, where income distribution and tax implications are all important, so significant additional manual work is needed. They also can’t fulfil the reporting obligations placed on a trust, which are becoming increasingly important as the ATO steps up its scrutiny of these structures.

“The Survey found a significant need among accountants and advisers for portfolio administration software for non-SMSF portfolios.”

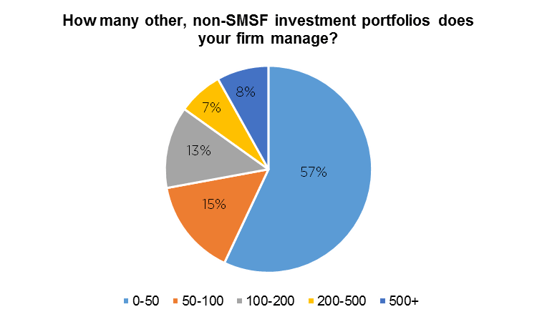

The Digital Trends Survey found a significant need among accountants and advisers for portfolio administration software for non-SMSF portfolios. Almost 30% say they administered at least 100 such portfolios and almost 1 in 10 managing more than 500 portfolios each. Figures from the ATO show that while the number of SMSFs has grown strongly in the past 5 years, the number of trusts has grown at a similar rate, from about 700,000 in 2009-10 to more than 800,000 in 2014-15.

By far the majority of survey respondents, 75%, did their own SMSF administration rather than outsourcing the function. Confirming the fragmented nature of the SMSF administration industry, the most often cited administrator had only a 10% share of respondents.

The Class Solution

Class recognised the need for an industry strength cloud software solution for SMSF administration and in 2009 launched Class Super, now the leading cloud SMSF administration software. The clear advantages of cloud administration, evident from the success of Class Super, as well as the growth of non-super portfolios led in 2015 to the introduction of Class Portfolio, a powerful administration and reporting system for companies, trusts and individuals.

To learn more call 1300 851 057, email us at sales@class.com.au or visit class.com.au

.png)

Grow your business. Request a personalised Demo.

We’re here to help. Why not request a demo, so you can see first-hand how intuitive our solutions are, and the dramatic productivity gains they can deliver?